In the meantime there were other transactions in the account, so the balance after her little "breaking and entering" stunt was R350 in arrears. Good job I have a R500 overdraft or the transaction would have bounced and I would have been hit with some outrageous bank fees. Of course the FNB doesn't have any security mechanisms in place to warn me that someone from SARS was looking at my balance to see what she could take, but they did tell me once the money was gone. Nice one, FNB. You do a great job of facilitating criminal activity, much like HSBC, another wunch of bankers.

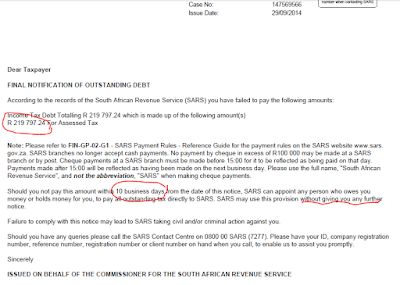

It turns out there is a nasty little program in the SARS computers somewhere that can spit out notices like the one shown above, issued (but not signed) on behalf of the Commissioner. And of course computers never make mistakes, and the information input on the system is flawless in all respects. Never mind that the Tax Administration Act of 2011 never contemplated that such notices would not be issued by a human being, let alone not checked by one before signing it. It is quite specific that it should be an official:

179 (1) A senior SARS official may by notice to a person who holds or owes or will hold or owe any money, including a pension, salary, wage or other remuneration, for or to a taxpayer, require the person to pay the money to SARS in satisfaction of the taxpayer's outstanding tax debt.This becomes important for the next paragraph, which states

179 (2) A person that is unable to comply with a requirement of the notice, must advise the senior SARS official of the reasons for the inability to comply within the period specified in the notice and the official may withdraw or amend the notice as is appropriate under the circumstances.As an exercise in pointlessness I called the SARS number 0800 00 7277 and asked for the name of the official who issued my particular notice, and predictably I was told that it was issued by a computer and I should go to my nearest SARS office. That's the standard response by a call centre operator when they don't know what to do and won't put me through to a supervisor.

- Lose the application entirely;

- Fail to notify me when the application had been processed (I found out indirectly by accident);

- Ignore my objection letter to some of their original findings;

- Repeatedly call me for the money even though I kept having to explain that the Amnesty application was in progress;

- Take a year or so to realise that the third objection application form should be signed by me and not by the tax advisor;

- Lose the revised application/objection;

- "Agree" with my objection many months after I sent copies via email;

- In spite of "agreeing" with the objection, they took 7 months in 2014 to decide that the 2003, 2004 and 2005 tax returns were not in business earnings but personal earnings, even though the last paycheck I received was in October 2000;

- Write a letter to me on 15 Sept 2014 informing me of this, but not sending it via email (or post) until after the "Final Demand" of 29 Sept 2014 was already issued. Then they sent it to me via email, once the damage was already done.

Update Thursday 12 April: Amnesty department say they can't modify my 2003-2005 tax returns because the computer system won't let them. I guess a manual calculation is beyond them any more.

Update Thursday 14 May: I had a meeting with the Debt Management department at Megawatt Park (now unofficially known as MegaWTF Park) where they casually told me that the "Final Demand" doesn't need to be issued by anyone at all, and it was purely a courtesy that it was issued to me. We'll see about that. They also made a number of other outrageous statements, which will be the subject of several other blog posts.

Update Thursday 11th June: I got a letter from the head of the Amnesty department approving my 2006 Amnesty application, and my account now shows a credit balance of R87,864.58 ;-)

See also: Tax Collectors and Sinners and SARS is making me sick.